PeoplesBank: Your Farming Partner and Resource to Agricultural Success

Since opening our doors in 1864, PeoplesBank has been providing loans and financial services to farmers and Agribusinesses. We have a dedicated team, each with an agricultural background, available to partner and help navigate the variety of loan and business products that fit your needs. While rewarding, the nuances and challenges of the industry can be difficult to navigate. That’s why partnering with a local neighborhood bank is essential to helping business flourish.

Your Community is Our Community

We live and work in the agricultural communities we serve with each of our Agribusiness team having real life and current experience in farming operations. PeoplesBank has an affirmed commitment to Agriculture and are familiar with and understand our client’s use of land preservation/conservation easements. We understand the long hours, risk, and market fluctuations that affect each farming operation. We understand the important role youth play in agriculture and support local 4-H & FFA members at the various youth livestock sales in our market area. Because of our prolonged commitment to agricultural success, we are a proud past recipient of the Agribusiness of the year by the York Agribusiness Council.

Convenient Banking Options

While our focus on farmers has never wavered, the farm businesses and agricultural businesses industry has evolved. Equipment and operations are becoming more modern and high-tech, and time has become a valuable commodity. We match that need for innovation and flexibility by evolving our banking process. We offer online applications, standardized loan products to speed up process, and teleconference meetings to our clients.

Overview of Agricultural Banking Solutions

|

|

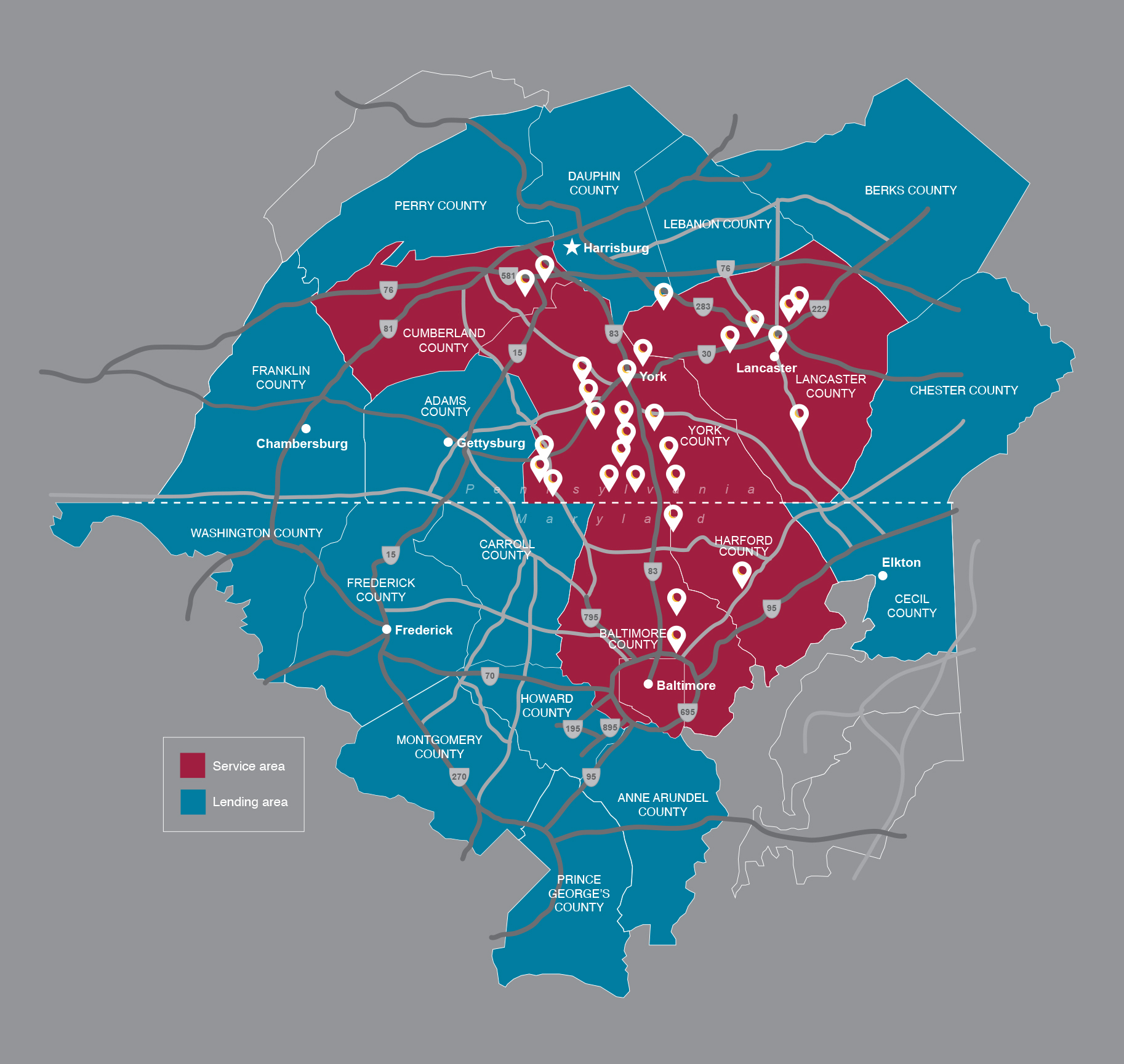

Our Agriculture Lending Area

Discover Farm Loan Options for Your Agricultural Business

Whether you’re looking for a used equipment loan or need a farm loan, PeoplesBank is here to guide you through the process and provide solutions to your business needs. For friendly, trustworthy advice from an experienced agricultural lender, please reach out to our agricultural lending team to discuss your need in more details at the form below.

Contact John Eaton & The Agricultural Lending Team

John Eaton Contact John Eaton and his dedicated lending team for more information on our agricultural banking products and services.

|

|

Not ready to chat on the phone? Fill out our generic questions contact form online, open an account or find a financial center near you today.