At PeoplesBank, we’re one of the best mortgage lenders in Pennsylvania and Maryland since the mid-19th century, helping clients understand their loan options and secure the funding they need. We’re a full-service independent bank that provides mortgage lending services and assistance in York, Lancaster, Baltimore and many other cities in the region. Anything that a big bank can provide you in terms of security and industry knowledge, we can match, all while keeping interests local and supporting our community.

Named Best Mortgage Lender 2021 by the

York Daily Record & Hanover Evening Sun

Financing a home is one of the most important decisions you will ever make. Whether you are just starting out, a growing family, looking to refinance an existing mortgage, or build a dream home, our local loan officers will help make the mortgage process smooth and simple for you – no matter where you are in life or what your home buying or refinancing needs may be. We currently lend in both Pennsylvania and Maryland.

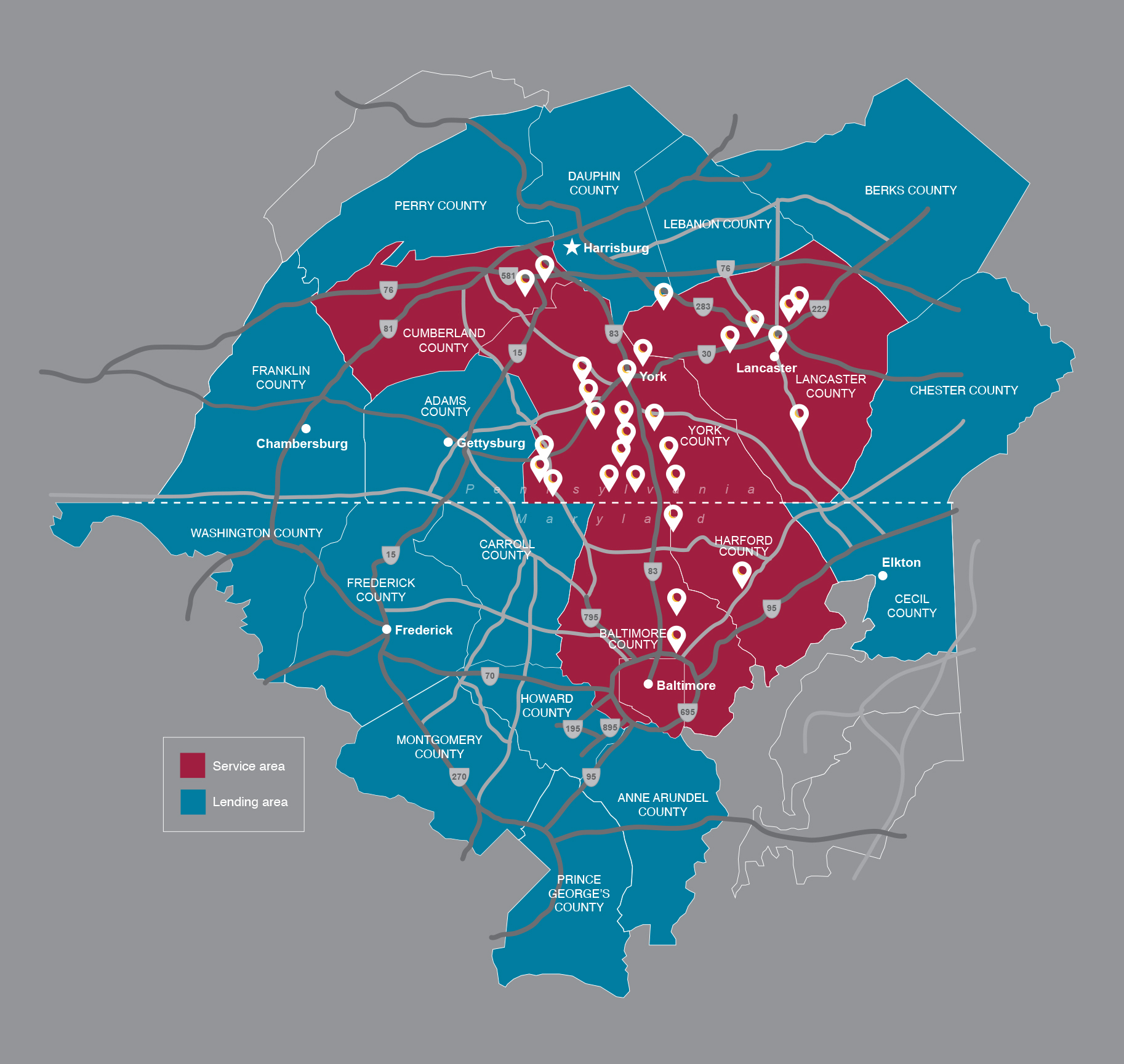

Our Mortgage Lending Area

The heart of our service area is York, Cumberland, Lancaster, Harford and Baltimore counties, but our mortgage lending area extends to many of the surrounding counties as shown on the map above.

If you are getting a mortgage loan, you are essentially getting a type of financing to purchase residential property. The loan uses your purchased home as collateral. This means that if you default on the financing the lender can foreclose on the home and sell it to recoup their money.

To keep your credit in good standing and to avoid foreclosure, you need to make mortgage payments in full and on time. Home mortgages come with terms and paperwork, and it’s important to understand the terms before you sign.

One thing you will notice is you are paying not just the amount borrowed (principal) but also interest, taxes and insurance. Sometimes, these parts of your monthly payment are referred to as PITI. At first, much of your monthly cost will go towards interest. Later in your loan, more of your monthly payment will go towards the principal. You can ask your lender for a table of how much you’ll pay through PITI. This table is sometimes known as an amortization schedule.